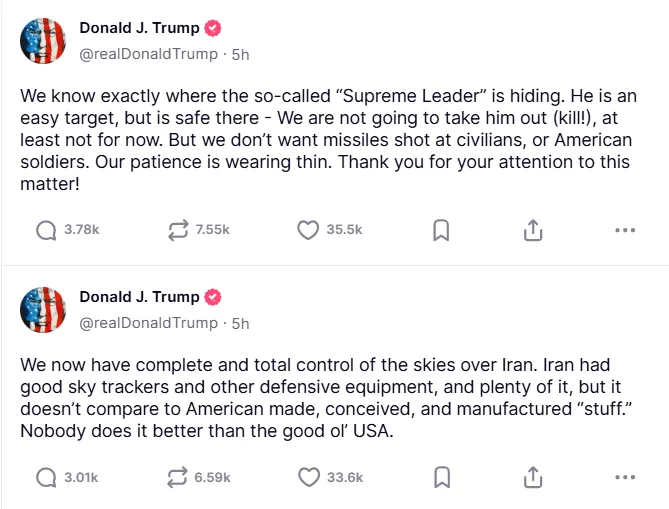

Context for Chatgpt: On the night of June 16, Israel launched an attack on Iran. Since then, the conflict has intensified with new strikes from Iran, while some statements of the US President are leaning to the potential entry of the United States.

Based on the recent contributions of President Trump and some geopolitical legends, the United States could decide to join the conflict. The market analysts expect to dominate global assets with a sense of caution, resulting in a decrease in liquidity in unstable sectors such as cryptocurrencies.

According to the formulas observed in previous geopolitical shocks, bitcoins that have currently exchanged around $ 104,500 could drop from 10 to 20 %.

During the first phases of large conflicts, investors generally turn into traditional refuge values such as US Treasury, Dollar and Gold.

In spite of some arguments, according to which it is coverage, crypto kept as an asset with a high risk during this type of episodes.

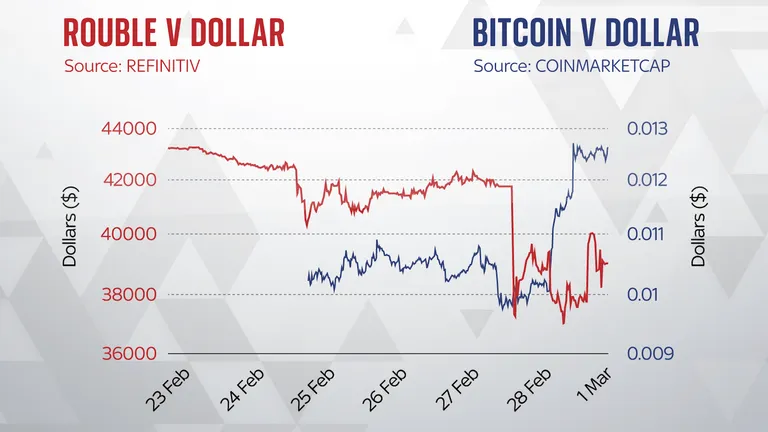

For example, during the war between Russia and Ukraine in 2022 Bitcoin dropped by more than 12 % per week after the initial invasion. He then partially recovered, but closely followed the stock markets throughout the conflict.

Activity on a chain often reflects this risk aversion. The effect of the lever tends to decrease, while the inputs on the exchanges increase and the volumes of trading decrease during the period of geopolitical stress.

These indicators indicate the investor’s leak and reduce risk.

Macroeconomic catalysts highlight the volatility of the market crypto

If the United States military action in Iran leads to a greater regional conflict, it could also increase the price of oil and the risk of inflation. This would put the federal reserve system pressure to delay a decline in rates or even consider new tightening.

Higher energy prices could return consumers inflation above the Fed’s target goal, especially because the WTI Brut already shows sensitivity to titles from the Middle East.

Therefore, the shocks of tenders associated with the war would probably disrupt maritime transport and increase the cost of inputs on a global scale.

In this case, the Fed would face a difficult dilemma between economic stability and control of inflation. The prolonged position of tightening cash tightening would increase the actual returns and suppress the crypt awards.

The revenues of US treasury accounts, which are already almost 4.4 % at a 10 -year obligation, could increase more if war expenditure expanded budget deficits. The United States national debt exceeded $ 36,000 billion, which increases the risk of long -term debt services.

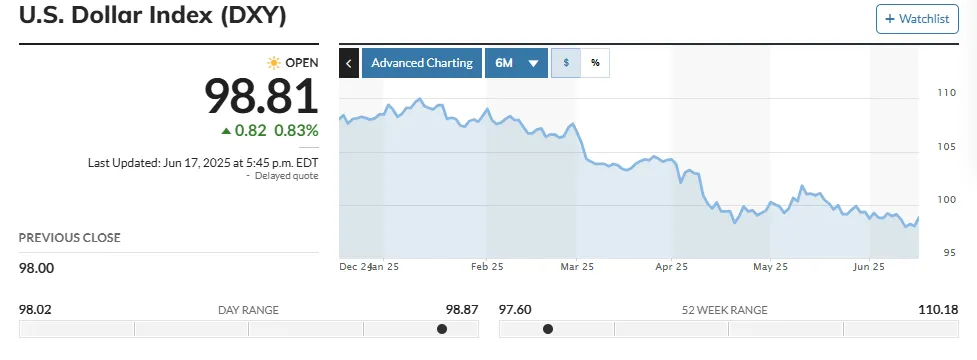

In parallel, the US Dollar Index (DXY), which is currently around 98.3, could strengthen, while global investors are looking for security denominated dolos.

In fact, the elevated dollar was historically lower for bitcoins and altcoins, especially in the emerging markets, where capital exits are governed by the increase in the dollar.

Crypto markets also tend to suffer when the volatility of traditional actions increases.

VIX, an indicator of fear, usually rises during the war or crisis, more tightening risk budgets and starting margin calls to crypto -gathering exchange.

It all depends on the length of the war and the fed reaction

If the United States’s intervention is short and leads to a rapid ceasefire, markets could bounce. Bitcoin previously recovered in 4 to 6 weeks after the initial shock, as observed significantly during the decline in past conflicts.

However, if the war expands or extends on a regional scale, the crypto could face the prolonged period of volatility, liquidity in the fall and reduced price.

The enemy of investors for speculative assets would probably remain low until the geopolitical situation appears.

This means that the persistent inflation caused by war -related disorders could revive the theme of bitcoins as a long -term coverage against the devaluation of trust currencies.

However, this bull scenario comes directly to competition with stricter monetary policy, which limits the potential for growing risky assets.

Institutional flows could mean a break or reduction in such conditions. Important indicators of changing the feeling in the coming weeks will be important indicators of changing the change in the feeling of (future) term contracts on CME, offer of stablecoins and layer flows 2.

The key levels to be monitored include psychological support for $ 100,000 for bitcoins and $ 2,000 for Ethereum.

If these levels are exceeded, the technical sale can speed up the pressure down to all the main tokens.

The elements to be monitored now

Investors should follow closely:

- Prices of oil and term contract.

- Statement of inflation and rate.

- Results of auction of the Ministry of Finance and differences in the return of obligations.

- Exhalation and use of the lever effect in the crypto.

- VIX and global risk indicators.

Thus, if the United States joins the conflict, the short -term future of bitcoins is likely to be dictated by macroeconomic conditions, not the foundations of crypto.

Traders should prepare for volatility, remain covered and watch geopolitical development in real time.

Morality of History: Neither crypto no one escapes chaos.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.