12h00 ▪

6

min at reading ▪

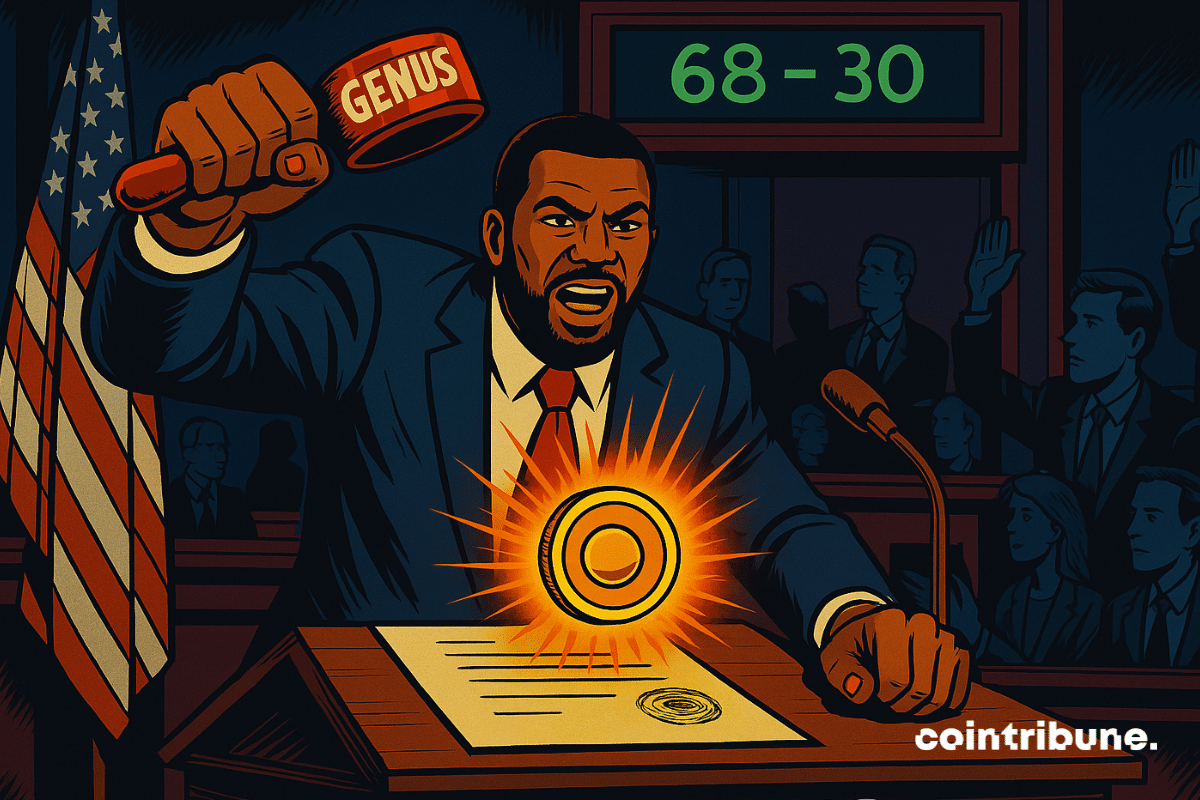

The United States has just engraved in its legislative marble in modern monetary history. By approval of the brilliant law, the US Senate formalizes the entry of the doven dollar into the legality. This is a turning point for digital finances and a strong signal to the rest of the world: the first economic power is finally organized around stablecoins, these tokens are based on a dollar that disrupts payments, stock exchange and monetary sovereignty. Let’s take a look at the significant facts of this progress.

In short

- The Senate is adopted by the brilliant law, the first federal legal framework dedicated to the Stablecoins.

- Each stablecoin must be supported by the dollar and audited every month.

- Banks, Fintech and regulated traders can now legally emit their own stable.

Genius Law: Stablecoins win their official framework

June 11, 2025 voted by the American Senate by 68 votes against 30 ProgressAdoption of genius (leadership and introduction of national innovation for the US Stablecoin Act) law). This first vote was not the final acceptance, but a final vote. The aim of blocking Filibusters, these parliamentary tactics of obstruction and allow holding and final vote.

It was held a few days later, By confirming the same score of acceptance in the plenary sessionBasic step to officially send the text to the House of Representatives. The Senate therefore ratified the national framework for stablecoins, these Crypt’s aspsets indexed to the dollar.

Obligations are clear: Each token must be 100 % supported by a dollar reserveverified by monthly audits. In addition, Any transmitter will have to comply with the flow regulations (AML) and know your customer regulations (KYC). This initiative includes banks, fintechs, but also commercial giants if they are regulated. Large non -financial techniques cannot directly release stablecoins.

The text determines:

The registered transmitter is necessary to guarantee the transmission of each Stablecoin unit to the US dollar at any time.

These few words are worth the revolution. No more regulatory blur, Make a way for architecture where a digital dollar can coexist with a crypt economyWithout antagonism.

Political force and crypt empire: the back of the American dream

For institutional momentum hides More problem dynamics. Genius Bill is also Election and financial problem for Donald Trump. In 2024 he influenced $ 57 million through World Liberty Financial and, according to his financial statement, held almost 16 billion WLFi tokens. Some of this income comes from the sale of chips associated with the presidential image.

The original text wanted Forbid any federal elected clerk and their families to use Stablecoins. This amendment has never been submitted by a vote. The Democrats condemned the orchestrated maneuver to legitimize Trump’s crypts. Senator Merley said:

These laws legitimize what looks like a massive fraud shrouded in the American flag.

Critics are also on the way. The project for the first time failed In the Senate, before returning to intensive negotiations. Senator Cynthia Lummis acknowledged:

I didn’t think it would be so difficult.

However, the text went through the voltage. Proof that crypto interests get into political kog.

Stablecoins redraws the power of the digital dollar

Stablecoins are no longer simple geek chips. They have become strategic tools that use payment giants and banks themselves.

Key characters:

- According to Deutsche Bank in 2023 in 2023 in 2023 in 2023, $ 28,000 billion;

- According to Defillam, more than 86 % of the Stablecoin market is indexed to the dollar (USDC, USDT);

- According to analysts, he invested a crypto of the sector of $ 250 million to support Congress 2024;

- JPMorgan launches JPMD, a deposit token issued at the base (Coinbase), intended for institutional;

- Shopify, via Coinbase and Stripe, already offers USDC payments on its platform.

Acceptance is very real. Even the head of OKX USA, Roshan Robert, greets a turning point:

The law creates a vital bridge to explore payments driven by blockchain.

Stablecoins becomeInterface between traditional financial and crypto innovations.

According to Mike Cahill de Douro Labs, ” If the US succeeds in this bet, it will not only lead to the crypto market, but will write the rules of the future global financial system Global ».

The world at the end of the dollar hegemony burns rumors. Some talk about dedollarization, others about the creation of digital Juan. But another way opens: a stable dollar. It is programmable, monitoring and now supported by the Federal law. Strategic tool. And maybe the last mutation of an aging currency. This is not an investment board.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Blockchain and crypto revolution! And the day when the impacts will be felt on the most vulnerable economy of this world, I would say against all hope that I was there for something

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.